By: Dr. Steven Baule, Superintendent of Muncie Community Schools—

Dear MCS Stakeholders,

I feel it is appropriate to take a few minutes to provide all stakeholders with an update regarding the corporation’s fiscal situation. In some ways, I understand this seems like old news. The Muncie Community Schools have been in a cost containment cycle for the better part of two decades according to many staff members who have worked here throughout that time. However, the key difference is that there is no longer any fund balance to utilize to allow the corporation to continue to deficit spend. The facts are not pretty but they are facts. In September 2015, the Board authorized an outside financial expert to prepare multiyear financial projections for MCS. Those were completed in March 2016, and shared with both the Board and the Muncie Teachers’ Association. The information was presented publically at the March 29, 2016 Board meeting and has been on the MCS website for over a month.

The projections show a dire fiscal picture for MCS unless it is able to make significant reductions in its spending habits. Based on enrollment projections provided by Ball State’s Center for Business and Economic Research, MCS is projected to have a $37,712,734 deficit across all funds at the end of 2019 without taking action to reduce expenditures. Other outside enrollment projections would lead to an even deeper deficit of over $51,000,000. I encourage all interested stakeholders to review these projections which are on the corporation website (www.muncie.k12.in.us). The recent audit completed by the State Board of Accounts (SBoA) shows a number of unfunded obligations which will need to be addressed as well. The final report from the SBoA should be available any day now via their website.

Given these realities, MCS CFO, Deb Williams, and I have reached out to several layers of state government to ask for assistance in addressing our situation including the State Superintendent of Public Instruction, the Governor, local legislators, the SBoA, the Department of Local Government Finance (DLGF) and individual members of the State Board of Education. Mrs. Williams and I met with representatives from the SBoA and the IDOE last week to discuss options allowing MCS to remain solvent. Three key issues came to light from the meeting:

- The negative impact of the Property Tax Circuit Breaker Law on MCS is potentially the most severe in the state. The DLGF projections for levies don’t take the circuit breaker into account. This year, MCS will lose more than $7.5 million in revenue, due to this law, including $3,005,942 in the Debt Service Fund. These losses will have to be made up from elsewhere in the budget. MCS’s bonded debt must be paid on time under Indiana law.

- MCS has to reduce its general operating expenditures to match revenues. As MCS has exhausted all of its reserves, we will have to reduce expenditures and also look to find new sources of revenue.

- The IDOE will assist us with trying to determine if some of the unfunded obligations identified by the SBoA can be written off.

To address these issues, the state departments have asked us to develop a deficit reduction plan in conjunction with an outside agency that they have worked with in the past. The Gary Schools have been working under a similar situation for some time now. One bright point is that the state agencies are hoping to fund this work without cost to MCS. The MCS leadership team has been working on generating such a plan so, this should not take that long. However, the corporation will have to find enough new sources of revenue, reductions and efficiencies to total at least $11.5 million. Some of these reductions have already been put in place to the scope of over $4.1 million in annualized savings. We are also working to continue to improve our partnerships with other local government bodies to improve efficiencies and reduce overall costs. Ultimately, MCS will most likely need to ask the voters for a referendum. I feel that it is important for MCS to have a more complete understanding of our long term needs and taken the steps necessary to be as efficient as possible before asking for more tax dollars.

The goal is to be able to make these reductions while still providing the widest, realistic range of opportunities for the children entrusted to the Muncie Community Schools and providing fair compensation for our staff. If individuals or groups have ideas on how to generate additional revenue for the schools, please feel free to contact Mrs. Williams or myself. Please feel free to contact me with questions.

Sincerely,

Steven M. Baule

Steven M. Baule, Ed.D. Ph.D. Superintendent

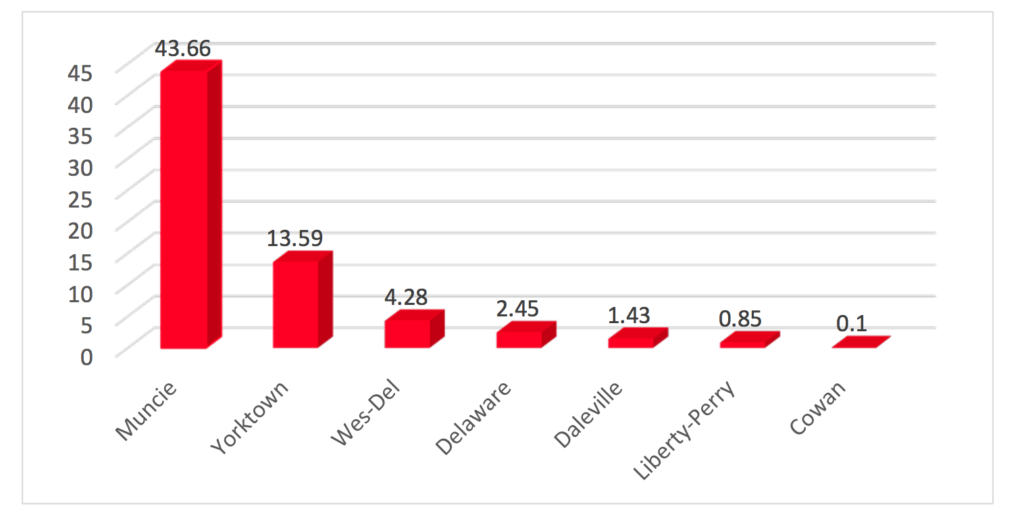

2015 Property Tax Cap Circuit Breaker Losses as a Percentage of the Total Levy for Delaware County Schools

Due to a number of competing factors with other taxing districts, the impact of the Circuit Breaker Law for Property Taxes is much greater on the Muncie Community Schools than on most other school corporations across the State of Indiana. In the last four years, MCS has lost $14,263,332 in circuit breaker losses to its Debt Service Fund and more than $29.3 million across all funds. Effectively, MCS loses nearly 44 cents on every property tax dollar due to the circuit breaker. Yorktown Community Schools loses nearly 14 cents per dollar and other county schools lose significantly less. The chart below shows the impact of the Property Tax Circuit Breaker on area schools based upon 2015 data.

The graph allows one to visualize why the circuit breaker is having such a negative impact on MCS but isn’t having the same impact on other area schools.

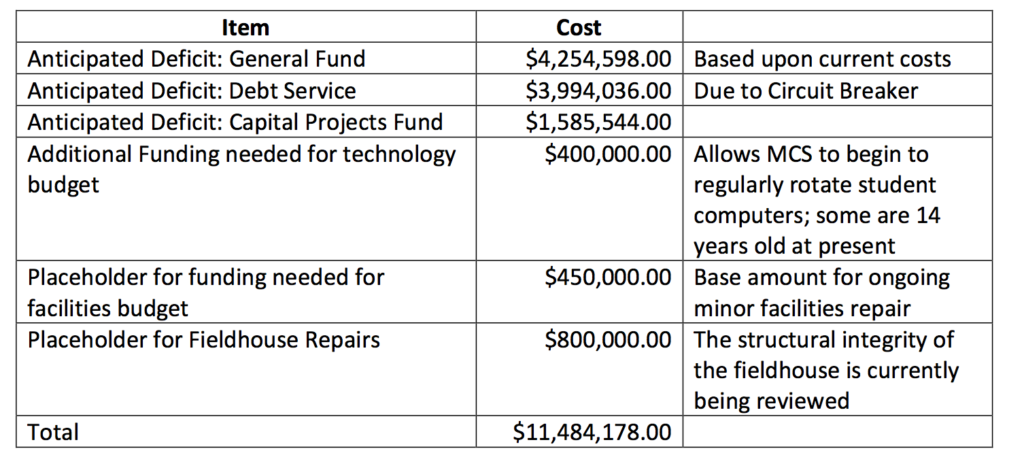

Breakdown of the Projected 2016 MCS Budget Shortfall

The following is a summary of the data presented in the March 29, 2016 MCS Fiscal Projections along with other relevant information about anticipated MCS facility needs.

The above reductions do not address existing unpaid obligations or the current process of borrowing through tax anticipation loans. These reductions still leave $10,283,400 in unpaid obligations in the General Fund. Those will still need to be addressed. Additionally, MCS is currently taking out approximately $10 million in tax anticipation loans in order to have a positive cash flow during the year. Both of these issues will also need to be addressed. All of these assumptions are based upon receiving $43,392,257 in state and federal funding. If those revenue sources are reduced, additional reductions may need to be made.